|

|

|

|

|

|

|

Food For Thought "Truth Is What Matters © copyrighted What Has Truly Caused the Job Losses and the Banking Crisis Meltdown The Facts ! February 6, 2010 - May 5, 2010 | by columnist David Lawrence Dewey "Reading provides knowledge... knowledge leads to answers." |

SEARCH HOME Previous Columns |

Make sure you click on MADEINUSA at top of website and start buying MADE IN AMERCA!

Neil Barofsky, Special Investigator for the Troubled Asset Relief Program, made the following statement in February this year, "We are still driving on the same winding mountain road, but this time, in a faster car", in a report to Congress that the issues that led to the 2008 financial meltdown remain unaddressed!

I have sat back and watched the insanity and ignorance of what has been occuring in this country the last six months and I simply can't stand it any longer. President Obama was elected for change. Well, folks, what has been created over the last 40 so years is not going to be fixed overnight and if you are wanting for it to be so, it is not going to happen. I have never seen such political doublespeak in my life that is spewing from the Democrats, Republicans, Conservatives, the Liberals and the Conservatives. I have never seen such ignorance in the American public as to what has led us to this crisis of a financial meltdown; almost causing a depression worse than the last, also an energy crisis and most important, the loss of over 8.8 million American jobs for good since 1999.

And these people from the Tea Party organizations that are popping up all over the country, they need to get real ! They are going around complaining about BIG government, no health care reform and other issues - they have no idea what they are talking about. President Obama is not a socialist marxist. Good grief, what do you think Social Security is and the various welfare programs, food stamps programs and Medicare that we have had in this country for over 40 years are? Do you think these are FREE government giveway programs? The hyprocrisy is unbelievable. The Tea Party folks and the Right Wingers talk about having less government, less social programs, but don't take away my Social Security, Medicare or food stamps. Ignorance, sheer ignorance and hyprocrisy! President Obama is trying to clean up crap that has been building for 40 so years. Am I happy with President Obama and some of his policy changes and shifts? NO! Obama is just a man. Whether Obama had been elected or someone else had been elected instead, these issues facing America that have been building for 40 so years, CANNOT be fixed overnight. America, if you think it can be, you are both ignorant and delusional, and most importantly, spoiled Americans. Your way of life is changing, and you don't like it. What is so crazy about this is, America, you brought most of this onto yourselves and you are taking no responsibility or accountability in what is facing America. I am being very blunt here because I simply can't stand the ignorance any longer.

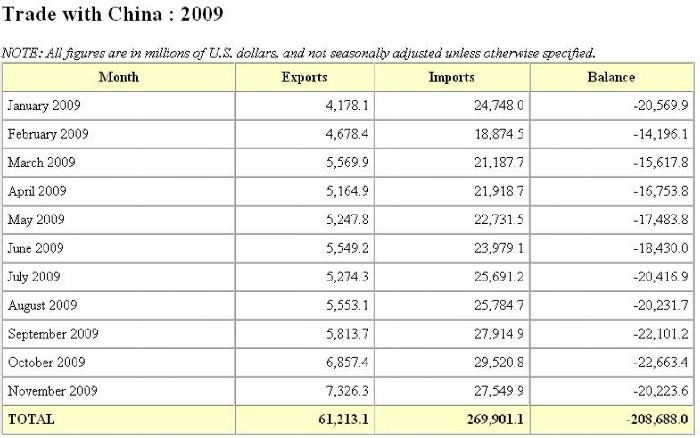

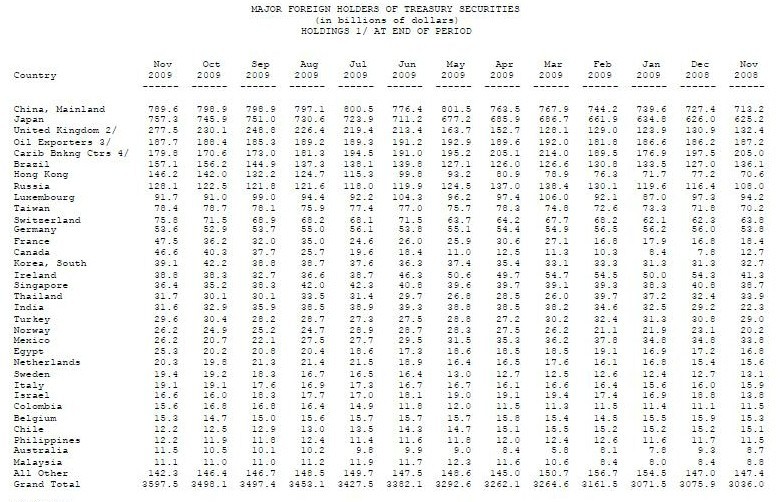

What you are about to read in the simplest terms and images below are the facts of what has caused the massive job losses over the last 15 or so years and what has caused the banking meltdown. If you care not to know the truth and facts so that CORRECT changes that need to be instituted are done, then continue to live in your ignorance. Doing so, will only eventually destroy American from within. The Communist Leader of China in 1964 said during the cultural revolution in China, "We will not have to raise a weapon to defeat America, she will destroy herself from within, and in the process we will wind up owning America."

UPDATE 2011: China now owns over $1.4 trillion in U.S. Treasury Notes.

HELLO America ?

I urge you also to send an email to your family and friends about this article. Help educate others on the facts!

The URL for this article is:

http://www.dldewey.com/feb10.htm

And I have to make one last comment...

Anyone that is listening to the likes of people like Sarah Palin, Rush Limbaugh, Sean Hannity, Michelle Bachman or some of the liberal idiots in this country as to how to fix this country, I must question the sanity and intelligence of the people in this country. Have we as Americans lost common sense and look at the obvious that must be done in the issues we are facing? Here is my suggestion to President Obama... keep it simple to the American people. Give them specific reasons why we must have health reform, energy reform. In some ways, I feel sorry for President Obama. I think that within a week in office, he was sitting at his desk and started to ask himself, "Good Lord, what have I gotten myself into?" I feel that President Obama was naive, just like many Americans thinking that these issues and problems in America were going to be an easy fix. I feel that President Obama had no idea of the control that the banking, oil, drug, lobbyists, self serving politicians and other political factions had in controlling this country. I think he is finding out and America it is time for you to wake up to the facts and truths of how we got here and stop expecting miracles overnight! The thing that all of us must stop doing is running from one politician to another regardless of the party they are aligned to and voting them in like what happened in Massachucetts recently because they are saying what we want to hear, not what we need and must hear to fix the problems in this country. Wake up America before it is too late!

Warren Buffet, billionaire investor recently said in an intervew that that he is taxed at the same rate as his secretary. What is wrong with this picture America? We have given the banking conglomerates, oil corporations, the drug corporations and other corporations a free ride for over 40 years! We must break the power of these corporations of the power and control that they have over Americans daily lives! And the only way to do that is stop running from one politician to another because they are saying what you want to hear and not what you need to hear. I have yet to see or hear a politician speak the truth of what the real problems are. President Obama has touched on it, but even he I feel has been afraid to really speak the truth out of fear. Remember, John Kennedy was killed and do we really know for sure by whom? Recent research has proven there were TWO shooters that day on the mall! Jacqueline Kenney left a signed letter, not to opened for 50 years after her death. I feel in that letter is the truth that she alone knew and the rest of the country and world will then know! This is how perverse our country has become. Why has it America? Because you have sat back America with your ignorance of believing in the same old lying politicians and voting them back in time and time again!

What Do These Corporations Have In Common?

Lost Jobs For Americans !

|

|

|

|

|

|

|

|

|

|

|

They started demanding in 1990 that manufacturers of products go overseas to make products cheaper, otherwise they would not sell their products in their stores any longer.

What Has Caused The Loss Of Jobs In America ?

|

YOU AMERICA !

|

WHY ?

Because YOU keep purchasing these cheap products:

Auto Parts |  Cell Phones |  Clocks |  Pots/Pans |  Clothes |  Televisions |  Tires |  Toaster |

Jewelry |  Silverware |  Towels |  Sheets |  Tennis Shoes |  Men's Shoes |  Women's Shoes |  Coats |

Men's Shirts |  Women's Shirts |  Toothbrushes |  Sheets |  Steel |  Drywall |  Generators |  IPODSr |

Watches |  Wallets |  Purses |  Undewear |  Socks |  Coffee Makers |  Irons |  Toys |

Made in these countries:

CHINA |

CANADA |

INDIA |

MEXICO |

PAKISTAN |

PHILLIPINES |

THAILAND |

JAPAN |

South Korea |

Brown Shoe Company in Illinois, in 1995, the last company-owned shoe factory in the United States closed its' doors. Brown had been in business

in the U.S. for over 75 years making shoes. The company operated factories in many rural towns in Missouri and Illinois.. Over 32,000 jobs were lost due to companies going overseas to make shoes.

In 1992, Florsheim Shoes Inc. also closed factories in Illinois and other states, 3,500 jobs lost.

For every 100 of you buying these products made in these countries,

you have cost (1) American to lose their job!

Bethlehem Steel, a 100 year old steel foundry in New York filed for bankruptcy in 2005. Why? Because trade barriers and especially trade tarriffs were lifted that steel could be bought from other countries, even to make our military tanks with. In 2006 we bought steel from China to make our tanks, planes and ammunition from. Textile manufacturing jobs that had been in this country for 50 years, lost to China, Indonesia, Philipines, Viet Nam and other such countries. This has resulted in good-paying blue-collar manufacturing jobs disappearing permanently to overseas as well as white-collar jobs earning as much as $18.00 an hour such as in the automobile parts industry. There are now over 34 million workers earning less than $8.70 per hour. They have seriously fallen behind in their standard of living because of short-sighted business cost-cutting, government deregulation and technology changes, but mainly moving jobs overseas where they pay workers anywhere from 45 cents an hour to 1.00 an hour.

Many sheet rock factories closed in the U.S. during the housing boom because it could be bought cheaper in China.

The result, over 100,000 homes it is estimated have sheetrock made in China that is making people sick due to the chemicals in it.

And let us not forgot about all the lead found in toys made in China, poisoning our children!

3,000 Call Centers Closed 3,000 Call Centers ClosedFrom 1998 to 2009, over 3,000 U.S. based call centers closed, going overseas to such places as Pakistan, India, resulting in over 215,000 jobs lost. Over 1,400 textile linen/fabric plants and 1,100 clothing manufacturing plants closed during this same time frame, resulting in over 245,000 more jobs lost. Hundreds of thousand of jobs lost in the auto industry during this time frame, never coming back! |

In Nov. 2008, I wrote an extensive column pertaining to the facts of what was causing the job losses and what was coming down in 2009 regarding the banking meltdown. Read my column to educate yourself on the facts, Job Losses and Unemployment Hit Record Highs.

In this column I explain exactly what led us to the banking meltdown. It started with President Carter, then President Reagan with the banking deregulation acts, continue through Bush 1, then Clinton, then Bush 2. None of them did anything to halt what was going to happen, it was simply a matter of time because we opened up pandora's box in 1986 letting crooks in the banking industry to create the meltdown. I also warned about this in my column in February, 2004, The Truth About Job Losses In America-More Job Losses To Follow. I also explained that had been brewing in the banking/mortgage areas since 1986 and what was going to happen by 2008, a financial meltdown!

What were the endresults of the Bank Act of 1980 and the other de-regulation banking acts that followed? Its' provisions increased bank cost, reduced competition, more inefficiency which caused bank failures of smaller banks and left others open to the banking conglomerates, resulting now in approximately seven major banking holding corporations owning approximately 75% of all banking centers in the country because they can now own branches in other states, previously prohibited. The negative impact of deregulation on income inequality holds, it does affect the poor more and the rich much less and it has taken the wealth away from the middle class. What was the final blow to the average American ?

IN 1999 GRAMM-LEACH-BILEY FINANCIAL SERVICES MODERNIZATION ACT WAS PASSED. FOR THE FIRST TIME EVER, IT ALLOWED BANKS TO UNDERWRITE SECURITIES AS WELL AS INSURANCE. WHILE SIMULTANEOUSLY, SECURITIES AND INSURANCE COMPANIES ARE NOW ALLOWED TO ENTER THE BANKING BUSINESS, IN ORDER TO COMPETE WITH BANKS. THERE IS NO MORE SEPARATION BETWEEN THE ENTITIES. DO YOU UNDERSTAND THE IMPORTANCE NOW OF NOT ALLOWING BANKS TO FUND AND SELL INSURANCE AND OTHER FINANCIAL PRODUCTS PREVIOUSLY PROHIBITED?

Below are the facts and if you ignore what the facts and truth are, you are not addressing the problem today and all you will do is complain and expect someone to walk in, wave a magic wand and fix everything overnight. That is not going to happen America! This took 40 years in the making, both by Republicans, Democtrats alike, it is not going to be fixed overnight!

The Banking Meltdown - The Cause

Carter, Reagan, Bush, Clinton and another Bush...

Deregulation and

the Slippery Road to Poisoned Assets

No one person is responsible for the credit crisis, the failure of investment banks, the insolvency of commercial banks world-wide, the

implosion of the world’s stock markets, or for leading us to the precipice of another great depression, but in started

during the Carter Adminstration.

Wall Street bankers, their exorbitantly well-paid lobbying army of former congressmen and former regulators and their greatly

contributed-to sitting legislators, the self-righteous and still mega-rich “former” Street executives have systematically eviscerated the muscle and bones from the regulatory bodies charged with protecting us from banks’ self-destructive greed. An inordinately powerful group of executive insiders from the once-deeply respected House of Goldman Sachs (GS) have served as U.S. Treasury secretaries and in innumerable other administrative capacities.

When Ronald Reagan assumed the presidency in 1980 the basic framework of deregulation was already in place. Indeed, Murray Weidenbaum, Reagan's

chairman of the Council of Economic Advisors, described Reagan as extraordinarily timid in taking leadership on deregulation.

By 1985 the Reagan administration had taken action in bus deregulation, oil price control, and piecemeal dealings with telephone, electric, and gas utilities. Airline deregulation was claimed that it would save the public $6 billion a year in airfares. It didn't!. Reagan also expanded the scope of the Carter administration's deregulation efforts.

In 1980, in a virtual landslide, Ronald Reagan was elected and grabbed the conservative mantle. A year later, the shock troops of the heralded Reagan Revolution launched their attack and embarked on a massive, systematic de-regulatory campaign. President Reagan’s first treasury secretary, former Merrill Lynch & Co. Chief Executive Officer Donald T. Regan, became chairman of the Depository Institutions Deregulation Committee.

In a burst of deregulatory bravado in 1982, Treasury Secretary Regan ushered through the Garn-St. Germain Depository Institutions

Act. Key provisions of the Act ultimately married with Treasur Secretrary Regan’s protection of the lucrative “brokered deposits”

business, in which Merrill was a major player, and paved the way for the future collapse of the savings and loan industry.

Some of the provisions in that 1982 Act would later be blamed for thousands of bank failures. The provisions permitted the following:

Allowed savings and loans to make commercial, corporate, business or agricultural loans of up to 10% of their assets.

Authorized a capital assistance program – the “Net Worth Certificate Program” – for dangerously undercapitalized banks, under

which the Federal Savings and Loan Insurance Corp. (FSLIC) and the FDIC would purchase capital instruments called “Net Worth

Certificates” from savings institutions with net worth/asset ratios of less than 3.0%, and would theoretically later redeem the

certificates as these shaky banks regained financial health. And, most frighteningly, raised the allowable ceiling on direct investments by savings institutions in nonresidential real estate from

20% to 40% of assets.

The ultimate prize was to be the undoing of the Glass-Steagall Act of 1933. Glass-Steagall, officially known as the Banking Act of 1933,

mandated the separation of banks according to the types of business they conducted. Investment banks, whose securities related

activities resulted in relatively large risks, were to be separate from commercial banks, whose depositors needed greater protection. The

Act created deposit insurance and the government wasn’t about to allow taxpayer-backed insurance of commercial bank deposits to be

exposed to securities related risks. It was a prudent and sensible separation. Bankers tried for years to undermine and overturn

Glass-Steagall, but it took time.

In 1987, Alan Greenspan replaced Paul A. Volcker – the stalwart Federal Reserve Board chairman, national inflation-fighting hero and

active proponent of Glass-Steagall (and now economic confidant of President-elect Obama).

In its twilight days, the Reagan administration was determined to further fertilize the seeds of deregulation and Greenspan’s Ayn

Rand-inspired “objectivist,” free-market philosophies would be the perfect embodiment of the deregulatory movement.

A year later – in 1988 – two very quiet revolutions sprouted that would ultimately hand bankers machine guns to rain terror on us all.

That year, the Basel Accord established international risk-based capital requirements for deposit-taking commercial banks. In a

by product of the calculations of what constituted mortgage-related risk (by nature of the loans’ long maturities and illiquidity) lenders

should be expected to set aside substantial reserves; however, marketable securities that could theoretically be sold easily would not

require significant reserves. Hello...did this not open the door for greedy crooks to enter?

To obviate the need for such reserves, and to free up the money for more-productive pursuits, banks made a wholesale shift from

originating and holding mortgages to packaging them and holding mortgage assets in a now-securitized form. Not inconsequentially,

this would lead to a disconnect between asset-quality considerations and asset-liquidity considerations. Meanwhile, over at the U.S. Commodities Futures Trading Commission (CFTC), the appointment of free-market disciple Wendy Gramm, wife of U.S. Sen. Phil Gramm, R-Tex., as chairperson, would result in her successful 1989 and 1993 exemption of swaps and derivatives from all regulation. Why did she ramrod this through? Read the next paragraph!

These actions would not be inconsequential in the aforementioned reign of terror that was still to come.

In 1993, with her agenda accomplished, Wendy Gramm resigned from her CFTC post to take a seat on the Enron Corp. board as a

member of its audit committee. We all know what happened there. Enron’s fraud and implosion became the poster child for

deregulation run amok and ultimately helped spawn Sarbanes-Oxley legislation, which has its own issues.

The constant flow of money to lobbyists and into legislators’ campaign coffers was paying off for the banking interests. The Fed, under

Chairman Greenspan, was methodically deconstructing the foundation of Glass-Steagall. The final breaching of the wall occurred in 1998, when Citibank was bought by Travelers. The deal married Citibank, a commercial bank, with Travelers’ Solomon, Smith Barney investment bank and the Travelers insurance business.

There was only one problem: The deal was clearly illegal in light of Glass-Steagall and the Bank Holding Company Act of 1956.

However, a legal loophole in the 1956 BHC Act gave the new Citicorp a five-year window to change the landscape, or the deal would have to be unwound. If aggressively flouting existing laws to pursue a personal agenda isn’t a perfect example of bankers’ hubris and greed, then maybe I’ve just got it all wrong.

Phil Gramm – the self serving free-marketer as he is known to be, Texas senator, and chairman of the U.S. Senate Committee on Banking, Housing and Urban Affairs – rode to the rescue, propelled by a sea of more than $300 million in lobbying and campaign contributions. In 1999, in the ultimate proof that money is power, President Bill Clinton signed into law the Gramm-Leach-Bliley Financial Services Modernization Act, at once doing away with Glass-Steagall and the 1956 BHC Act, and crowning Citigroup Inc. (C) as the new “King of the Hill.” This was the first legislation that had ever been done in America. It allowed

the pathway for banking comglomerates to take away the wealth of the middle class in America.

From his position of power, Sen. Gramm consistently leveraged his Ph.D in economics and free-market ideology to espouse the virtues of subprime lending, where he famously once stated: “I look at subprime lending and I see the American Dream in action.” If helping struggling borrowers pursue their homeownership dreams was such a noble cause, it might have been incumbent upon the senator to not block legislation advocating the curtailment of predatory lending practices. The Glass-Steagall Act took away the powers of each State to set usary interest limits, the most lenders could charge interest on loans. From 1989 through 2002, federal records show that Senator Gramm was the top recipient of contributions from commercial banks and among the top five recipients of campaign contributions from Wall Street investment brokerage houses. This is another reason why campaign reform must occur and

the recent ruling by the U.S. Supreme Court allowing corporations to pay for unlimited advertising commercials for politicans is an outright betrayal of the higest court in the land that is suppose to protect Americans. You can clearly see who has been bought and paid for on the Supreme Court. No one having common sense would have allowed this. A corporation does not have the same rights as someone who votes. This was the Defendants argument that corporations

since they pay taxes like Americans should have a right to vote and give their opinon of politicians through commercials. How insane is that? A corporation having the right to vote as an American taxpayer?

Since moving on from the Senate in 2002 to mega-universal Swiss banking giant UBS AG (UBS), where he serves as an investment banker and lobbyist, Gramm makes no apologies. “The markets have worked better than you might have thought,” he has been quoted as saying. “There is this idea afloat that if you had more regulation you would have fewer mistakes. I don’t see any evidence in our history or anybody else’s to substantiate that.” If Gramm living on another planet? This is one of the very things that caused the 1933 Depression. That is why the 1933 Banking Act was established to

prevent the very thing that has occured in this financial meltdown. And folks, what you have seen and the billions that have been used to bail out these toxic

comglomerate banking concerns is just the tip of the iceberg. What is coming down the road here soon, America you are not prepared for! Neil Barofsky, Special Investigator for the Troubled Asset Relief Program, made this statement, "We are still driving on the same winding mountain road, but this time, in a faster car", in a report this month, Febraury, 2010 to Congress that the issues that led to the 2008 financial meltdown remain unaddressed!

On April 28, 2004, in a fitting and perhaps flagrant final act of eviscerating prudent regulation, the SEC ruled that investment banks may essentially determine their own net capital. The insanity of that allowance is only surpassed by the fact that the SEC allowed the change because it was simultaneously demanding greater scrutiny of the books and records of what were the holding companies of investment banks and all their affiliates.

The tragedy is that the SEC never used its new powers to examine the banks. The idea was that Consolidated Supervised Entities (CSEs) could use internal models to determine risk and compliance with net capital requirements. In reality, what the investment banks did was essentially re-cast hybrid capital instruments, subordinated debt, deferred tax returns and securities with no ready market into “healthy” capital assets against which they reduced reserve requirements for net capital calculations and increased their leverage to as much as 30:1.

When the meltdown came the leverage and concentration of bad assets quickly resulted in the shotgun marriage of insolvent Bear Stearns Cos. to JP Morgan Chase & Co. (JPM), the bankruptcy of Lehman Brothers Holding (LEHMQ), the sale of Merrill Lynch to Bank of America Corp. (BAC), and the rushed acceptance of applications by Goldman and Morgan Stanley (MS) to convert to Bank Holding Companies so they could feed at the taxpayer bailout trough and feast on the Fed’s new Smörgåsbord of liquidity handouts. There are no more CSEs (the SEC announced an end to that program in September). The old investment bank model is dead. The motivation for bankers to undermine and inhibit prudent regulation is inherent in banker compensation incentives. The September Journal of Financial Research sums up the problem on compensation by concluding: “Firm characteristics that influence managerial compensation include leverage (as a measure of observable risk) market-to-book ratio of assets, size and shareholder return. Evidence suggests that Bank Holding Companies may be exploiting the deposit insurance mechanism because leverage is a significant factor in our results for incentive-based components of compensation. Our results strongly support the view that fundamental shifts in business activities of Bank Holding Companies have influenced their compensation strategies”. No one would tempt an alcoholic by putting one in charge of a liquor store and neither would anyone put a fox in charge of a henhouse. So why are greedy bankers being allowed to rewrite banking regulations to enrich themselves while leveraging taxpayers, destroying trillions of dollars of hard-earned savings and sinking us into a potential depression? Until transparency sheds light on the backroom dealers and influence peddlers that aligned with Wall Street against Main Street, we will continue to be held hostage to the same greed and avarice that manifests itself in too many human beings who actually have the power to execute their personal agendas.

The history of S&L greed and fraud – which resulted from brokered deposits and deregulation – wasn’t forgotten by legislators. But it was steamrolled by bankers pursuing an even greater unshackling of the regulations that constrained their ambitions.

By 1985 doubts were rising about the wisdom of deregulation. The movement fostered reckless financial speculation. Higher interest rates deepened the recession of 1979-1982. When the economy finally came out of the 1982 recession, the recovery took place with minimal regulatory inhibition applied to interest rates, something that had not occurred since the Harding-Coolidge days of the 1920s. Estimates put the expense of deregulation at several

hundred billion dollars in additional interest payments between 1980 and 1988.

While the banking industry initially did well in a deregulated economy, marginal sectors of the economy did not do as well. The housing industry, which is dependent on borrowing, suffered. Deregulation also influenced air travel in a very negative way.

During the four years following deregulation in 1978, weekly departures from large cities had risen 5 percent, but weekly departures from small towns dropped 12 percent. By 1988, 140 small towns had lost all air service. Still, air fares were markedly lower throughout the world because of U.S. deregulation Institutions Deregulation and Monetary Control Act (DIDMCA) of 1980 allowed thrifts to make consumer loans up to 20 percent of their assets, issue credit cards, accept negotiable order of withdrawal (NOW) accounts from individuals and nonprofit organizations, and invest up to 20 percent

of their assets in commercial real estate loans.

From the Reagan administration's point of view, organized labor was another drag on business development. Labor unions had enjoyed the right to organize workers since the New Deal legislation of the 1930s, and in the intervening decades organized labor had accumulated a good amount of political and

economic power. Reagan signaled a new less-idealistic attitude toward organized labor when he confronted the Professional Air Traffic Controllers Organization (PATCO) in 1981. This was the beginning of the destruction of the labor unions in the U.S. Breaking the labor unions would be the final act that corporations needed to do anything they wanted. PATCO president Robert E. Poli had supported Reagan during the 1980 presidential election. When PATCO workers illegally went on strike Reagan followed the advice of Secretary of Transportation Drew Lewis and fired all of the striking workers. With no sympathy in the administration, organized workers found their position slipping in the face of foreign competition and the antiinflationary policies of Federal Reserve chairman Paul Volcker. By the end of the decade, only about 12 percent of American workers in private industry belonged to unions. Workers in regulated industries had often received 30 percent to 100 percent higher wages than people with comparable skills in the economy at large. Federal and state regulation had allowed these costs to be passed on to consumers, but when competition replaced regulation companies began to drive down the cost of labor.

Between 1980 and 1994 more than 1,600 banks insured by the Federal Deposit

Insurance Corporation (FDIC) were closed or received FDIC financial assistance.

From 1986 to 1995, the number of US federally insured savings and loans in the United States declined from 3,234 to 1,645. This was primarily, but not exclusively, due to unsound real estate lending.

The market share of S&Ls for single family mortgage loans went from 53% in 1975 to 30% in 1990. US General Accounting Office estimated cost of the crisis to around USD $160.1 billion, about $124.6 billion of which was directly paid for by the US government from 1986 to 1996. That figure does not include thrift insurance funds used before 1986 or after 1996. It also does not include state run thrift insurance funds or state bailouts The damage to S&L operations led Congress to act. The savings and loan crisis of the 1980s and 1990s (commonly referred to as the S&L crisis) was the failure of 747 savings and loan associations (S&Ls aka thrifts). A Savings and Loan is a financial institution in the United States that accepts savings deposits and makes mortgage, car and other personal loans to individual members. The ultimate cost of the crisis is estimated to have totaled around $160.1 billion, about $124.6 billion of which was directly paid for by the US government—that is, the US taxpayer, either directly or through charges on their savings and loan

accounts ]—which contributed to the large budget deficits of the early 1990s.

The concomitant slowdown in the finance industry and the real estate market may have been a contributing cause of the 1990–1991 economic recession. Between 1986 and 1991, the number of new homes constructed per year dropped from 1.8 million to 1 million, which was at the time the lowest rate sinceWorld War II.

Elimination of regulations initially designed to prevent lending excesses and minimize failures, failed. Regulatory relaxation permitted lending, directly and through participations, in distant loan markets on the promise of high returns. Lenders, however, were not familiar with these distant markets. It also permitted associations to participate extensively in speculative construction activities with builders and developers who had little or no financial stake in the projects.

An agreement between the Clinton administration and congressional Republicans, reached during all-night

negotiations which concluded in the early hours of October 22, sets the stage for passage of the most

sweeping banking deregulation bill in American history, lifting virtually all restraints on the operation of the

giant monopolies which dominate the financial system.

The proposed Financial Services Modernization Act of 1999 would do away with restrictions on the

integration of banking, insurance and stock trading imposed by the Glass-Steagall Act of 1933, one of the

central pillars of Roosevelt's New Deal. Under the old law, banks, brokerages and insurance companies were

effectively barred from entering each others' industries, and investment banking and commercial banking

were separated.

The Depository Institutions Deregulation and Monetary Control Act of 1980, signed into law by President Jimmy Carter, was the first major reform of the U.S. banking system since the Great Depression.

While touted as a boon to consumers, the law was actually a gold mine for bankers. Among other requirements and banker “gifts” the 1980 Act’s provisions:

And America, you sat on our behinds and let this happen!

The certain result of repeal of Glass-Steagall will be a wave of mergers surpassing even the colossal

combinations of the past several years. The Wall Street Journal wrote, "With the stroke of the president's pen,

investment firms like Merrill Lynch & Co. and banks like Bank of America Corp., are expected to be on the

prowl for acquisitions." The financial press predicted that the most likely mergers would come from big

banks acquiring insurance companies, with John Hancock, Prudential and The Hartford all expected to be

targeted.

Kenneth Guenther, executive vice president of Independent Community Bankers of America, an association

of small rural banks which opposed the bill, warned, "This is going to begin a wave of major mergers and

acquisitions in the financial-services industry. We're moving to an oligopolistic situation."

One such merger was already carried out well before the passage of the legislation, the $72 billion deal which

brought together Citibank, the biggest New York bank, and Travelers Group Inc., the huge insurance and

financial services conglomerate, which owns Salomon Smith Barney, a major brokerage. That merger was

negotiated despite the fact that the merged company, Citigroup, was in violation of the Glass-Steagall Act,

because billionaire Travelers boss Sanford Weill and Citibank CEO John Reed were confident of bipartisan

support for repeal of the 60-year-old law. Campaign of influence-buying was alive an well as you see.

They had good reason, to be sure. The banking, insurance and brokerage industry lobbyists have combined

their forces over the last five years to mount the best-financed campaign of influence-buying ever seen in

Washington. In 1997 and 1998 alone, the three industries spent over $300 million on the effort: $58 million

in campaign contributions to Democratic and Republican candidates, $87 million in "soft money"

contributions to the Democratic and Republican parties, and $163 million on lobbying of elected officials.

The chairman of the Senate Banking Committee, Texas Republican Phil Gramm, himself collected more

than $1.5 million in cash from the three industries during the last five years: $496,610 from the insurance

industry, $760,404 from the securities industry and $407,956 from banks.

During the final hours of negotiations between the House-Senate conference committee and White House and

Treasury officials, dozens of well-heeled lobbyists crowded the corridors outside the room where the final

deal-making was going on. Edward Yingling, chief lobbyist for the American Bankers Association, told the

New York Times, "If I had to guess, I would say it's probably the most heavily lobbied, most expensive issue"

in a generation.

While Democratic and Republican congressmen and industry lobbyists claimed that deregulation would

spark competition and improve services to consumers, the same claims have proven bogus in the case of

telecommunications, airlines and other industries freed from federal regulations. Consumer groups noted that

since the passage of a 1994 banking deregulation bill which permitted bank holding companies to operate in

more than one state, both checking fees and ATM fees have risen sharply.

Differing versions of financial services deregulation passed the House and Senate earlier this year, and the

conference committee was called to work out a consensus bill and avert a White House veto. The principal

bone of contention in the last few days before the agreement had nothing to do with the central thrust of the

Clinton, Republicans agree to deregulation of US financial system bill, on which there was near-unanimous bipartisan support.

The sticking point was the effort by Gramm to gut the Community Reinvestment Act, a 1977 anti-redlining

law which requires that banks make a certain proportion of their loans in minority and poor neighborhoods.

Gramm blocked passage of a similar deregulation bill last year over demands to cripple the CRA, and bank

lobbyists were in a panic, during the week before the deal was made, that the dispute would once again

prevent any bill from being adopted.

Gramm and other extreme-right Republicans saw the opportunity to damage their political opponents among

minority businessmen and community groups, who generally support the Democratic Party. Gramm

succeeded in inserting two provisions to weaken the CRA, one reducing the frequency of examinations for

CRA compliance to once every five years for smaller banks, the other compelling public disclosure of loans

made under the program.

The latter provision was particularly offensive to black and other minority business and community groups,

who have used the CRA provisions as a lever by threatening to challenge mergers and other bank operations

which require government approval. In most such cases, the banks have offered loans to businessmen or

outright grants to community groups in return for dropping their legal actions. These petty-bourgeois

elements have been able to posture as defenders of the black or Hispanic community, while pocketing what

are essentially payoffs from finance capital and concealing from the public the details of this relationship.

The banks and other financial institutions did not themselves oppose continuation of the CRA, which they

have treated as nothing more than a cost of doing a highly profitable business in minority areas. Loans tied to

the CRA average a 20 percent rate of return. Financial industry lobbyists complained that they were being

caught in a crossfire between the Republicans and Democrats which was unrelated to the main purpose of the

bill.

The Clinton White House threatened to veto the bill if CRA provisions were substantially weakened, in

response to heavy pressure from the Congressional Black Caucus and the Reverend Jesse Jackson, whose

Operation PUSH has made extensive use of CRA in its campaigns to pressure corporations and banks for

more opportunities for black businessmen. But eventually the White House caved in to Gramm, accepting his

amendments so long as the program remained formally in place.

The Clinton White House similarly retreated on pledges that consumer privacy would be protected in the legislation. Consumer groups pointed to the potential for abuse of financial information once giant conglomerates were

created which would handle loans, investments and insurance at the same time. For example: a bank could

refuse to give a 30-year mortgage to a customer whose medical records, filed with the bank's insurance

subsidiary, revealed a fatal disease.

The final draft of the bill contained a consumer privacy protection clause, but it is extremely weak, applying

only to the transfer of information outside of a financial conglomerate, not within it. Thus Citigroup will be

able to pass on financial information about its bank depositors to Travelers Insurance, but not to an outside

company like Prudential. Even that limitation would be breached if there was a contractual relationship with

the outside company, as in the case of a telemarketer which did work for Citigroup and was given private

information about Citigroup depositors to aid in its telephone solicitations. As you see, all of this was leading to

a serious threat to Americans financial stability. Bottom line, it was all about the banks getting more of Americans wealth out

of their hands and into the bankers.

The proposed deregulation will increase the degree of monopolization in finance and worsen the position of

consumers in relation to creditors. Even more significant is its impact on the overall stability of US and world

capitalism. The bill ties the banking system and the insurance industry even more directly to the volatile US

stock market, virtually guaranteeing that any significant plunge on Wall Street will have an immediate and

catastrophic impact throughout the US financial system.

As a recent history of that era notes: "The more than five thousand bank failures between the Crash and the

New Deal's rescue operation in March 1933 wiped out some $7 billion in depositors' money. Accelerating

foreclosures on defaulted home mortgages—150,000 homeowners lost their property in 1930, 200,000 in

1931, 250,000 in 1932—stripped millions of people of both shelter and life savings at a single stroke and

menaced the balance sheets of thousands of surviving banks" (David Kennedy, Freedom from Fear, Oxford

University Press, 1999, pp. 162-63).

The separation of banking and the stock exchange was ordered in response to revelations of the gross

corruption and manipulation of the market by giant banking houses, above all the House of Morgan, which

organized huge corporate mergers for its own profit and awarded preferential access to share issues to favored

politicians and businessmen. Such insider trading played a major role in the speculative boom which

preceded the 1929 crash.

Over the past 20 years the restrictions imposed by Glass-Steagall have been gradually relaxed under pressure

from the banks, which sought more profitable outlets for their capital, especially in the booming stock market,

and which complained that foreign competitors suffered no such limitations to their financial operations. In

1990 the Federal Reserve Board first permitted a bank (J.P. Morgan) to sell stock through a subsidiary,

although stock market operations were limited to 10 percent of the company's total revenue. In 1996 this

ceiling was lifted to 25 percent. Now it will be abolished.

The Wall Street Journal celebrated the agreement to end such restrictions with an editorial declaring that the

banks had been unfairly scapegoated for the Great Depression. The headline of one Journal article detailing

the impact of the proposed law declared, "Finally, 1929 Begins to Fade." However, all of this simply opened up

Pandora's box to crooks that lead to the financial meltdown of 2009 and 2009.

This comment underscores the greatest irony in the banking deregulation bill. Legislation first adopted to

save American capitalism from the consequences of the 1929 Wall Street Crash is being abolished just at the

point where the conditions are emerging for an even greater speculative financial collapse. The enormous

volatility in the stock exchange in recent months has been accompanied by repeated warnings that stocks are

grossly overvalued, with some computer and Internet stocks selling at prices 100 times earnings or even

greater.

And there is a much more recent experience than 1929 to serve as a cautionary tale. The financial deregulation

bill was passed in the early 1980s under the Reagan administration, lifting many restrictions on the activities of savings and loan associations, which had previously been limited primarily to the home-loan market. The result was an orgy of speculation, profiteering and outright plundering of assets, culminating in collapse and

the biggest financial bailout in US history, costing the federal government more than $500 billion. The repetition of such events in the much larger banking and securities markets would be beyond the scope of any federal bailout. The further banking de-regulations acts that followed, only worsened the problem,

leading to the financial meltdown of 2008 and 2009, almost resulting in a depression worse than the 1930's.

Healthcare Reform, Energy Reforms

I have written extentively why we must have Health Reform and Energy Reforms in this country. We are on a collision source that either of these will cause a depression. If you have not read my columns on these issues, I hope you will to read the facts as to why

we must have these reforms.

The Deficit Crisis and Save Social Security ! The Facts and Truth You Need To Know America ! - July 15, 2011

Here's my final thoughts...

IF YOU CROSS THE NORTH KOREAN BORDER ILLEGALLY YOU GET 12 YEARS HARD LABOR.

IF YOU CROSS THE IRANIAN BORDER ILLEGALLY YOU ARE DETAINED INDEFINITELY.

IF YOU CROSS THE AFGHAN BORDER ILLEGALLY, YOU GET SHOT.

IF YOU CROSS THE SAUDI ARABIAN BORDER ILLEGALLY YOU WILL BE JAILED.

IF YOU CROSS THE CHINESE BORDER ILLEGALLY YOU MAY NEVER BE HEARD FROM AGAIN.

IF YOU CROSS THE VENEZUELAN BORDER ILLEGALLY YOU WILL BE BRANDED A SPY AND YOUR FATE WILL BE SEALED.

IF YOU CROSS THE CUBAN BORDER ILLEGALLY YOU WILL BE THROWN INTO POLITICAL PRISON TO ROT.

IF YOU CROSS THE U.S. BORDER ILLEGALLY YOU GET:

Isn't # 12 above, the bottom line to all of this? Learn the facts, the truth, then speak up ! Until you learn the facts, the truth, stop making yourself look like a fool by complaining and talking about things and following idiots that don't know what they are talking about. Empower yourself with knowledge, then speak up!

Have you learned anything by reading the facts and truth in this article?

One last thing...you need to learn about the vaccine crisis in this country causing autism in children!

Read actors Jenney McCarthy and Jim Carrey's website regarding this travesty!

McCarthy - Carrey Generation Rescue.ORG

Natural News.com

http://www.naturalnews.com/028109_Andrew_Wakefield_Jenny_McCarthy.html

* simply put in your email address to read the entire article!

You can also pull down Dr. Wakefied's study plus this new monkey study that shows vaccines do cause autism!

Dr. Wakefield Statement

Wakefield Study that has been erronously discredited after 12 years, why now?

Here is the new Monkey study showing the Hep B vaccine causes Autism in Monkeys!

Fourteen Studies

~ David Lawrence Dewey

Email your family and friends the link to this article which is: http://www.dldewey.com/feb10.htm

On another note:

Global Warming has been an issue of mine since 1997 when I wrote my first columns, alerting my readers to melting ice caps due to carbon dioxide levels increasing in the ice at the poles! In ten years, it has increased over 400%. This is what has been causing the ice caps to melt. All you have to do is view satellite images of the poles from ten years ago to last year, we have lost over 35% of the ice caps. We have lost major ice glaicers all over the world, providing drinking water and water for farming. In China, they are facing huge food shortages because (4) of their major ice glaciers providing water for farming in their main farming area have melted! If you have not read my columns over the years, I urge you to and support measures to end man made global warming. And to this day, we still have ignorant, stupid people out there that still say there is not such a thing as global warming. Good Lord, just look at the weather changes. Do you need to be hit over the ahead to wake up to the truth?

My columns:

Global Warming - Fact or Fiction - August, 1997

Rain forests diminishing by 10% a year. Worldwide oxygen production decreasing.

Global Warming August 1997

Global Warming: Is It Too Late? - March 2006, Updated April, 2007, August 2008

Ice Shelf Falls Off Into Artic - Is Global Warming Real Enough Now?

Global Warming March 2006, Updated April 2007, August 2008

~ ~ David Lawrence Dewey

|

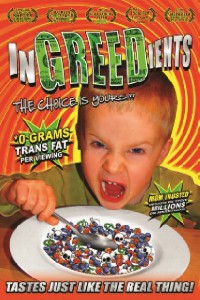

IMPORTANT UPDATE: Make sure you read about the new documentary  Read About the Film - Click Here Do you want to die young with a diseased heart? Develop needless high blood presure? Develop diabetes type II ? If not - then you need to watch this new documentary ! THE FILM HAS WON FIVE FILM AWARDS ! |

Would you like to save up to 25% on your gasoline cost in your car or truck?

Then read what actual users of this phenomenal device are raving about ! CLICK HERE |

Improve your health with these amazing water wands !

The water wand introduces passive natural energy waves into clean drinking water, fruit, vegetable and vitamin drinks. This process causes water molecules to shed excess minerals and other substances, which break down into finer more usable nutrients. Since the water molecule becomes lighter, you can drink more liquids. This process balances pH, transports nutrients, and absorbs more waste in the body at a faster rate. Drinking more water and fluids helps increase your rate of hydration, assimilation of nutrients and elimination (detoxification). This subtle energy is discernable and gives a feeling of well-being. red blood cells before and after use. CLICK HERE |

Do you care about your health, the health of your children, your family?

Then make sure you read my column:

Hydrogenated Oils - Silent Killers

Learn the truth about these deadly oils in our food supplies

Read about Greta Ferebee's and my efforts in a nationwide petition campaign to get these and other toxins out of the food supply. VISIT our website:

*The claims made about these products on or through this site have not been evaluated by the United States Food and Drug Administration and are not approved to diagnose, treat, cure or prevent disease. The information provided on this site is for informational purposes only and is not intended as a substitute for advice from your physician or other healthcare professional or any information contained on or in any product label or packaging. You should not use the information on this site for diagnosis or treatment of any health problem or for prescription of any medication or other treatment. You should consult with a healthcare professional before starting any diet, exercise or supplementation program, before taking any medication, or if you have or suspect you might have a health problem.

In the United States, medical diagnosis and treatment is constrained by law to be the exclusive purview of state licensed practitioners. The diseases discussed on this site are serious, sometimes life threatening matters. Neither the content nor the intent of this column may or should be construed as the giving of medical advice or as recommending any treatment of any kind. The purpose of this column is to support informed discussions, to provide medical research links and and to help the patient identify the doctors who keep up with advances in their field.

| © All Rights Reserved. Use of these collected data is restricted. Newspapers, syndicates or publications wishing to use this information or his columns, email your request with details to Mr. Dewey's agent. Email Contacts for DL Dewey. For any other use, DLDEWEY for permission to use column or columns, detailing your request to use which column or columns and for what purpose. |

| HOME | Previous Columns | Email Contacts | Advertising |

|

©1997-2013 Rocky Mountain Publicity Last Modified: June 1, 2013 |